- During this year, Argos has recorded the highest levels of sales and EBITDA in our history, COP 8.5 trillion and COP 1.5 trillion, respectively.

- The United States, Argos´ main operation, has grew 23% in revenue and 26% in EBITDA in the quarter.

- We have reached a consolidated leverage level of 2.8 times, the lowest in the last 9 years.

Consolidated results:

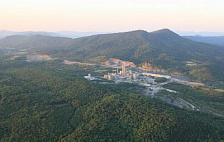

Argos, the cement company of Grupo Argos, whose purpose is to make possible the construction of housing and infrastructure dreams that enable more sustainable, thriving and inclusive communities, presented results leveraged on its supply strategy and logistics network that allowed it to achieve record high in exports, as well as positive market dynamics.

Year-to-date, and in comparable terms, as of September, the company reported the highest levels of sales and EBITDA in its history, with figures of COP 8.5 trillion and COP 1.5 trillion, and increases of 20.7 % and 4.3 %, respectively. It should be noted that during the third quarter the EBITDA increased 27% and we had an increase of 20 basis points in the EBITDA margin during the period.

Regarding volumes, from January to September, Argos delivered 12.3 million tons of cement, 2.3% less and 5.8 million cubic meters of concrete, 8.7% more.

Juan Esteban Calle, CEO: «We are excited to deliver positive results to our shareholders which exhibit that the strategies we are implementing, in terms of deleveraging, efficiency, logistics network integration and price recovery, are bearing fruit. Amid strong inflationary pressures in all markets, we were able to expand profitability and margins versus last year. On the other hand, in Cementos Argos we are aware that the value of the share does not yet reflect the fundamentals of our company and we are committed to continue carrying out initiatives such as the listing on the NYSE that generate more value for shareholders and other stakeholders».

USA:

During the third quarter, revenues were USD 414 million, which represents an increase of 22.9 % compared to the same term in 2021. For its part, EBITDA reached USD 77 million and increased 26%.

Regarding volumes, from July to September, we sold 1.6 million tons of cement, which represents an increase of 6.2% and 1.1 million cubic meters of concrete, 3.6% more than in the same months of last year. The foregoing, in large part, thanks to the solid demand in the states where we are present.

Colombia

Revenues during the quarter reached COP 705 billion, which means an increase of 10.6%, mainly leveraged in an efficient commercial strategy that seeks to offset inflation. For its part, EBITDA reached COP 157 billion, 14.5 % higher than the same period of the previous year. Likewise, the EBITDA margin was 22.3% and registered an expansion of 75 basis points. In addition, we highlight that the exports from Cartagena grew 37% and reached 319,000 tons, the highest quarterly figure in Argos´ history.

During these three months, cement shipments remained stable, while the concrete business has continued its sustained recovery, supported by infrastructure and formal housing projects. The latter were 712,000 cubic meters and increased by 7.8 %.

Caribbean and Central America:

During this quarter, we highlight the positive performance of revenue, which was USD 136 million and grew 8.3%. For its part, the EBITDA was USD 31 million and remained stable compared to the same months of 2021.

On the other hand, cement shipments were around one million tons and decreased 12.7%, affected, in part, by the serious social situation that Haiti is going through, the winter and the government transition in Honduras and scheduled maintenance in the Dominican Republic. In contrast, concrete shipments were 77,000 cubic meters and increased 59.2%.